Tax write for us

Some of these tax acclaims and deductions may be new to you, and you may have heard from other people but didn’t know you qualified. Several key tax benefits have been significantly extended in 2021, and you can qualify now for the first time or receive a larger benefit. If your income has decreased in 2021 or you have retired, started a new job, started your own business, taken continuing education courses, paid for childcare expenses, or had medical expenses, c now is a good time to check You are eligible for an additional tax help. Here are some often overlooked tax credits and deductions and how to make the most of them when filing your 2021 taxes.

Increased tax breaks for summer camps.

Tax credit for higher-income non-graduate classes.

Bonus credit to save.

Tax-deductible savings for your part-time job.

Overlooked Tax Benefits for Freelancers and Freelancers.

Deduction for home office for the self-employed.

Tax-deductible HSA premiums if you buy your own insurance.

Medical trips, long-term care premiums, and other expenses.

Charitable contributions for non-individuals.

Energy-related tax credits for cars and homes.

How To Get The Prime Tax Refund This Year.

Biggest Summer Camp Tax Break

The Biggest Summer Camp Tax Break You may know about the Child and Dependent Tax Credit, and now it’s even better. “There were big changes in 2021,” said Mark Steber, director of tax information at Jackson Hewitt. The loan has expanded significantly and can now be worth up to $4,000 for one child or $8,000 for two or more children. You may not know how many expenses can be eligible: You can count the cost of day care, daycare, babysitting, before and after school care, and even the cost of summer camps for children under 13 for you and your spouse who are employed or job-seekers (Overnight camps do not count).

In addition, the level of income to qualify for the most significant credit significantly increases. Unfortunately, you can only get a credit for 50% of your qualifying expenses if your adjusted gross income from 2021 is $125,000 or more. The percentage allowed gradually decreases due to higher income levels and higher credit if your income is $438,000 or more. For more material, see IRS Publication 503, Child Care and Dependent Care Expenditures.

How to Submit Your Article to businesssweb?

To Write for Us, you can email at contact@businesssweb.com

Why Write for Businesssweb – Gold Write for Us

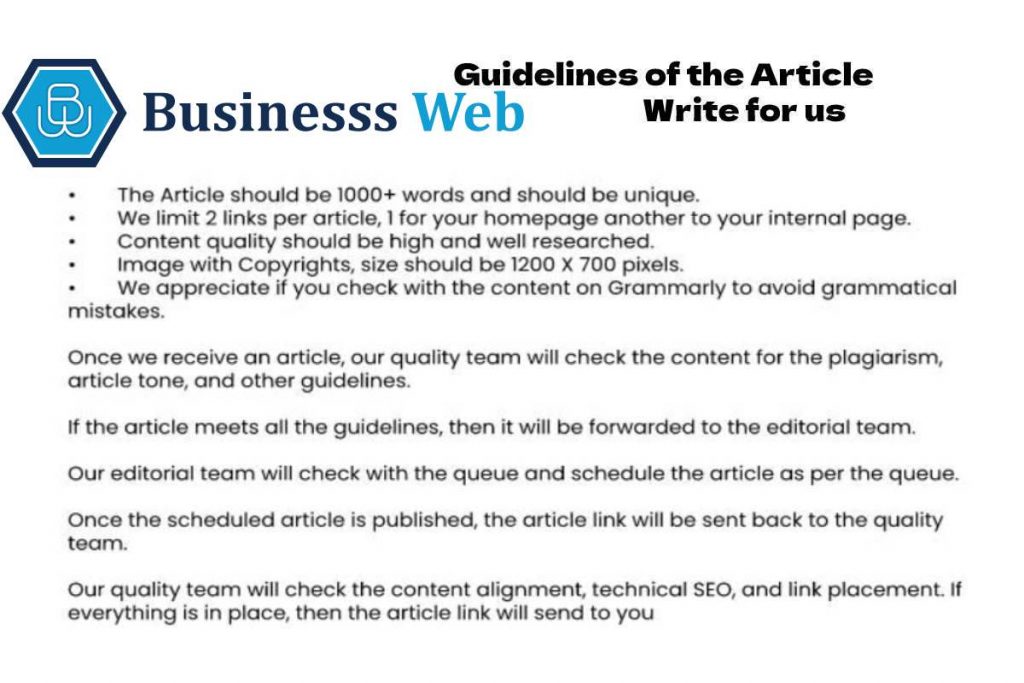

Guidelines of the Article – Gold Write for Us

Search Terms Related to Tax

duty

tariff

tax

tax collection

assessment

laying taxes

levying

imposition

impost

stretch

amount charge

taxpayer

Search Terms Related to Tax Write for Us

Tax “guest post

Tax “write for us”

Tax “guest article”

Tax “guest post opportunities”

Tax “this is a guest post by”

Tax “looking for guest posts”

Tax “contributing writer”

Tax “want to write for”

Tax “submit blog post”

Tax “contribute to our site”

Tax “guest column”

Tax “submit Face Book Ads”

Tax “submit Face Book Ads”

Tax “This post was written by”

Tax “guest post courtesy of ”